2021 Recap: A Major Year in ASO

The year 2021 was a much-anticipated year for app marketing and ASO, with the app ecosystem starting on an all-time high! At the same time, we also spent some of 2021 wondering when the economy would be able to restart “after” COVID-19.

The majority of expert conversations revolved around when Apple would enforce its privacy changes and how much impact they would have.

2021 brought more announcements and changes than expected, making it a pivotal year in shaping the role of ASO in app marketing. As we get to the end of the year, let’s review the most important ASO changes of 2021.

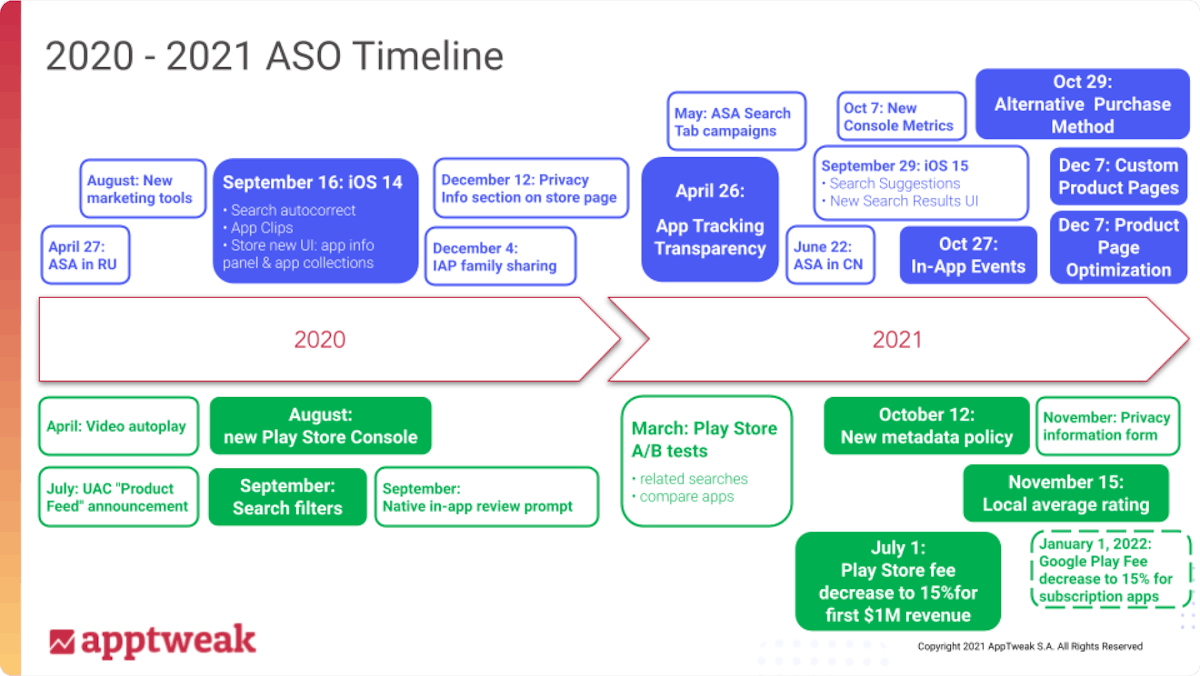

2020-2021 ASO Timeline by AppTweak.

2020-2021 ASO Timeline by AppTweak.

1. Impact of iOS privacy changes on ASO & app marketing

Many discussions in early 2021 revolved around Apple’s impending App Tracking Transparency framework, posing a risk for apps losing access to vital user device identifiers crucial for deterministic ad campaigns. Even though iOS 14.5 released ATT on April 26 and most apps only felt its full impact from June onward due to gradual implementation, developers began preparing new marketing strategies from the start of the year.

Learn more about Apple’s App Tracking Transparency framework and its impact on ASO.

With expectations that paid user acquisition (UA) performance campaigns would experience a severe drop in efficiency and become more expensive, app marketers showed a newfound interest in ASO, which manifested in 3 main ways:

- More app companies started opening ASO positions or increasing the size of their ASO team, with the goal of mitigating—or even canceling out—their losses in paid UA with a new influx of organic users. In turn, this led to an increase in the competition for organic search visibility on the App Store, with ASO practitioners simultaneously needing to educate executives on the differences between ASO and paid UA.

- Many companies boosted the share of Apple Search Ads (ASA) in their paid UA mix because Apple’s ad network enjoys partial exemption from ATT rules, where users opt-out instead of opting in. The trend picked up speed when Apple launched Search tab campaigns in May, and the inclusion of China in the countries where Apple Search Ads are available in June added to the momentum of this shift.

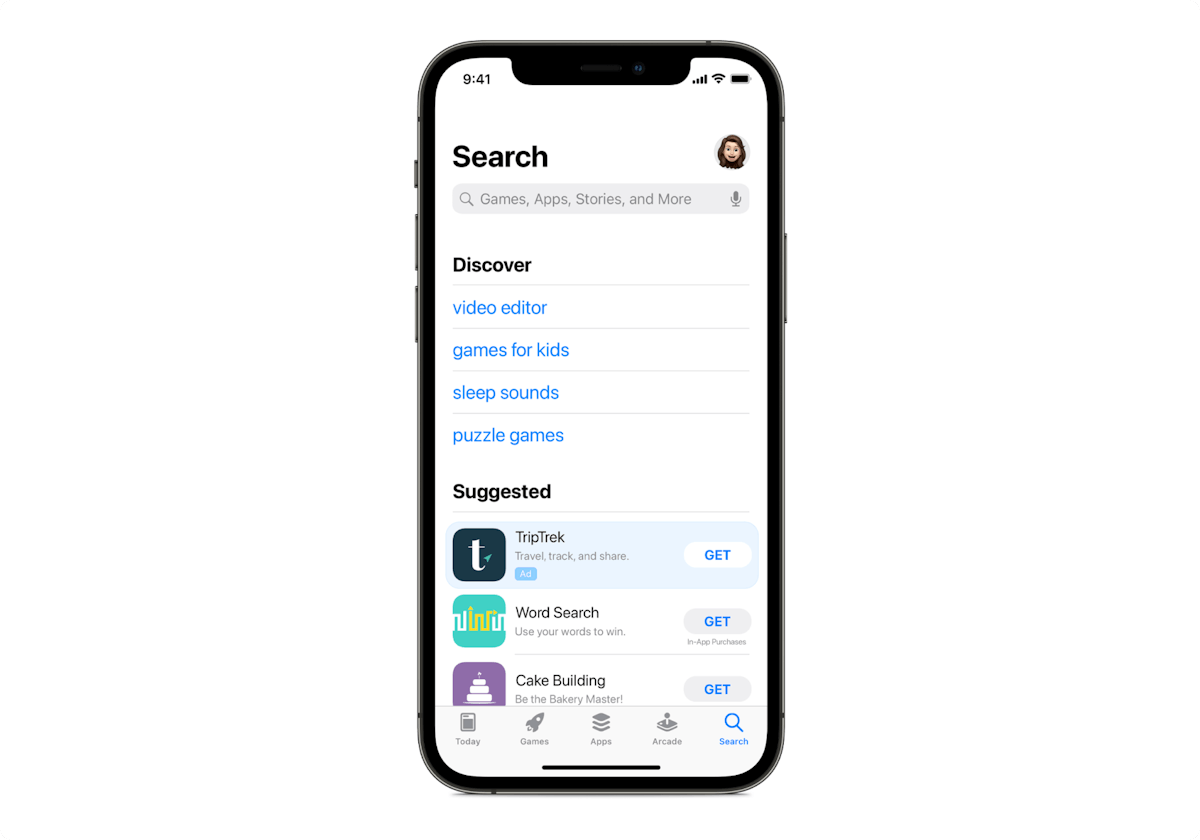

Search Tab Campaigns. Source: Apple.

- Companies delved into the data offered by App Store consoles and ASO tools. The ATT installment led to a decrease in user attribution abilities with mobile measurement platforms. Marketers grappled with reconciling data discrepancies from various sources when gauging marketing efforts’ efficiency using probabilistic methods or uplift measurements.

Apple’s privacy changes in the first half of the year revealed the interplay between paid UA and ASO, favoring the latter. This trend sped up in the second half of the year when Apple announced iOS 15 and began introducing new features

2. iOS 15: A new era for ASO

Apple announced new App Store features for iOS 15 at the WWDC in June. These plans sparked immediate discussion about in-app events, product page optimization, and custom product pages. Developers were urged to gear up for increased App Store usage. Even before these features were released, Apple made notable changes to reassert its marketplace as a key player in app discovery.

iOS 15’s September 29 release introduced search suggestions, adding an extra layer to keyword optimization. It also removed screenshots from search results for already installed apps, potentially altering the competition for search visibility.

This change increased the importance of in-app events. They could replace screenshots in search results for already installed apps, helping popular apps keep their competitive advantage in search.

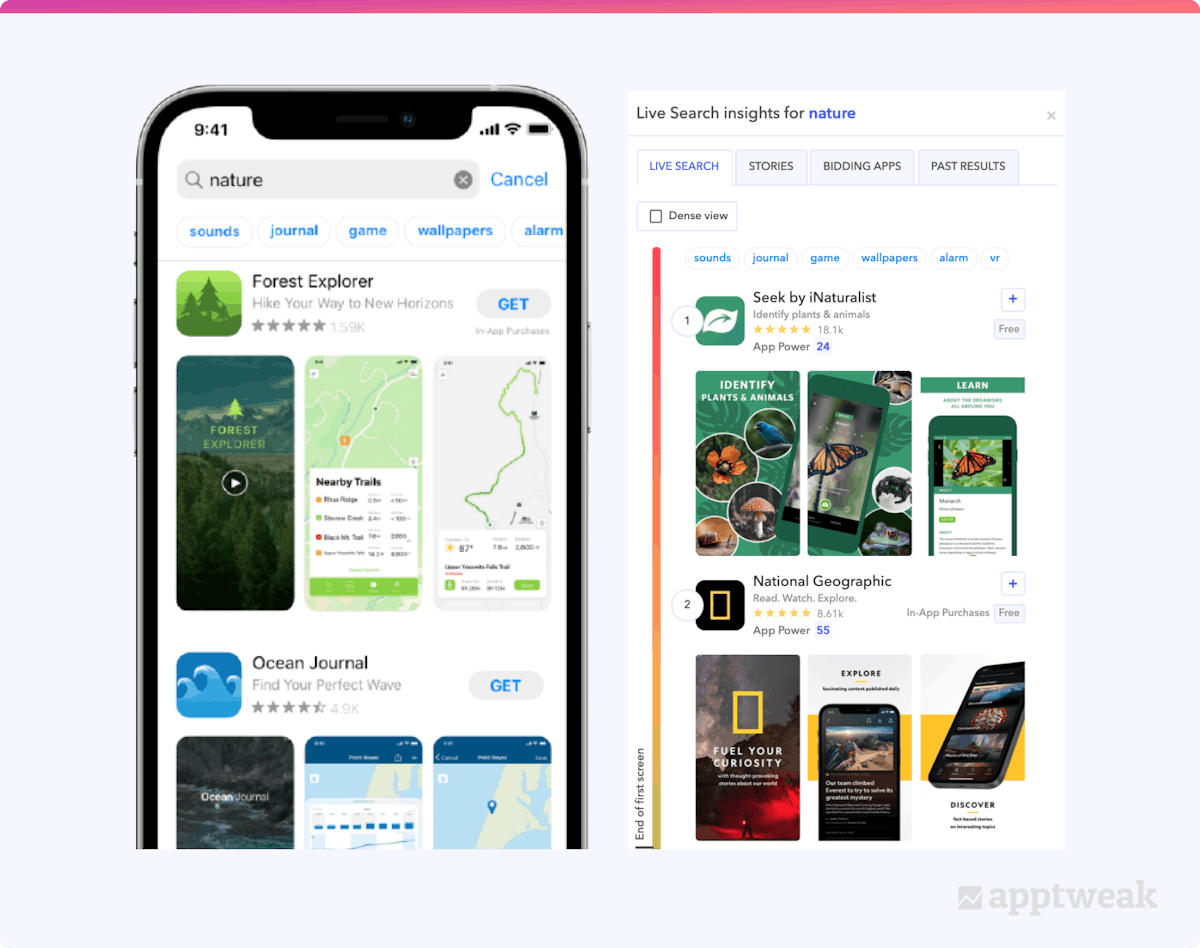

Search suggestions on the App Store (also available on AppTweak).

Search suggestions on the App Store (also available on AppTweak).

With iOS 15, Apple unveiled new App Store Connect metrics. These metrics detail new downloads versus redownloads, track app updates and proceeds, and offer a source-specific breakdown.

While marketers didn’t eagerly anticipate this change, it enhanced the value ASO practitioners bring in analyzing data beyond just organic results. This is particularly relevant as other data sources like MMPs lose reliability and companies seek multiple data sources over a single provider.

However, bigger changes came later with the release of in-app events on October 27, and product page optimization and custom product pages on December 7.

- Product page optimization, an A/B testing tool native to the App Store, wasn’t revolutionary as Google Play had a similar tool. But its arrival was long-awaited due to its potential to assess creative changes’ impact on App Store conversion. It also allowed marketers to update screenshots and app previews without new app build submissions, subject to Apple Editors’ review for compliance.

- In-app events and custom product pages ushered in a new era for App Store marketing. They have created new engagement and retargeting campaign opportunities and moved away from the concept of promoting an app through a single store page to all users in one country or region

Learn all about iOS 15 with our Conversion Optimization Content Hub.

Not to underestimate changes on Google Play in 2021

Turning to the Play Store, it may seem that Google had a much quieter 2021 at first glance.

Nevertheless, Google’s numerous updates throughout the year have significant implications. These include the expansion of the LiveOps beta, new metadata policies, and changes in the average rating calculation.

Google Play promotional content (LiveOps) beta

Google Play pioneered the promotion of in-app content through the LiveOps beta, outpacing iOS’s in-app events.

Originally, only mobile game developers could access it. However, Google has since opened the closed beta to more developers and revised its LiveOps policy to allow digital sales ads, a move Apple doesn’t permit. In fact, Apple dismissed some Black Friday in-app event submissions from developers for simply offering discounts instead of highlighting specific in-app content

Although unclear when Google will make LiveOps available to all app developers, these changes seem already well underway in 2021.

Play Store metadata policy updates

In 2021, Google Play’s significant change was a new metadata policy focusing on two areas:

- The title character limit reduction from 50 to 30 aligns Google Play more with the App Store. This change may reflect Google’s intent to ensure simpler, accurate app titles, easing its algorithm’s task.

- New rules around app icons, titles, and descriptions aim to prevent developers from exploiting consumers with misleading terms like “free” or “#1.”

While the new changes are generally positive for ASO, Google’s review algorithms have shown initial challenges in differentiating semantic contexts.

For example, apps using phrases like “hands-free” or “first love” may trigger the algorithm, even if they’re not promoting a price or ranking.

As a result, it is likely that ASO practitioners will look for circumvention strategies in 2022.

Read this blog to learn about important changes Google Play made to its metadata policy in 2021

Average rating formula

Google’s revised app rating formula, though less discussed, could significantly affect the Play Store. Users who value app ratings may see both pros and cons due to this shift from global to local ratings.

- Positively, apps may gain better conversion in markets where they invest more, potentially enhancing customer satisfaction.

- Negatively, new market launches may face early challenges, requiring more time for visibility and conversion.

- SEO side effects could also harm apps with low US ratings due to limited presence, as web crawlers often focus on US pages.

.png?auto=format,compress&q=75&w=1200) Comparing Web and Play Store ratings for Deezer in France.

Comparing Web and Play Store ratings for Deezer in France.

4. More changes to the App Store/Google Play in the making

Changes in 2021 will extend into 2022, addressing privacy on Google Play and introducing new app store fee policies

- In store privacy, Google follows Apple. In February 2022, the Play Store will reveal data collection details by apps and third parties. Developers submitted information for display through a form accessible since November.

Furthermore, starting next year, Google will restrict access to device identifiers for kids’ apps. This might signal the start of a stricter policy for all apps and advertisers, inspired by Apple’s ATT.

- Finally, both Apple and Google have started moves regarding app store fees in 2021. In July, Google disclosed a fee cut from 30% to 15% for developers’ initial million dollars. Later, it introduced a simplified fee policy for subscription-based apps, reducing it to 15% starting January 1, 2022.

Meanwhile, Apple handled the legal aftermath with Epic. Apple introduced a new policy allowing iOS developers to communicate alternative payment methods. However, Apple later secured an injunction suspension, preventing developers from enabling in-app alternatives. Despite the suspension, new legal developments, like South Korean legislation, prompt Apple and Google to contemplate fees on all app revenues, even external purchases.

It appears 2022 is set to be another important year for ASO, so stay tuned for our predictions in 2022!

Georgia Shepherd

Georgia Shepherd

Micah Motta

Micah Motta

Oriane Ineza

Oriane Ineza

Lina Danilchik

Lina Danilchik

Alexandra De Clerck

Alexandra De Clerck